Klarna is the first buy now, pay later (BNPL) platform. It allows customers to purchase items without using their own money or credit cards at checkout.

Customers have up to 30 days to pay. They can also choose four installment payments. These are interest-free if paid on time.

This system makes Klarna a great alternative to credit cards. It helps people shop without going into debt.

For bigger purchases, Klarna offers financing plans up to 36 months. This is the only option that has interest fees.

Klarna is widely used for ecommerce payments. It also works for in-store payments at many large retailers. Today, it is a trusted platform for both online and retail payments.

Following Klarna, many companies now focus on e-wallet app development. Businesses offering website development & mobile app development are also building smooth checkout systems. These systems give customers flexible and easy payment options.

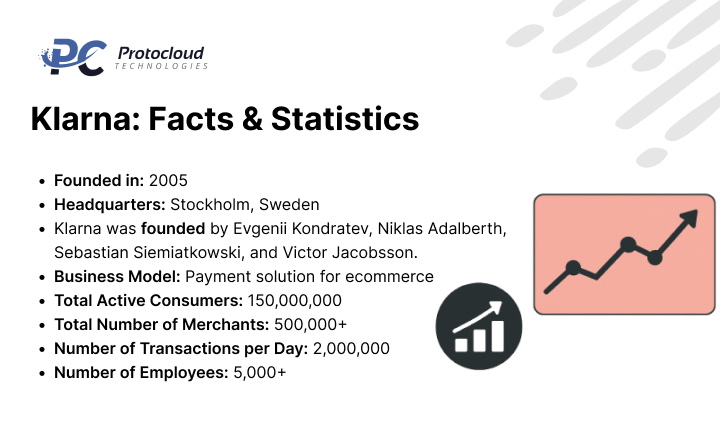

Klarna: Facts & Statistics

The following are some important Klarna facts and Klarna statistics you should know:

- Founded in: 2005

- Headquarters: Stockholm, Sweden

- Klarna was founded by Evgenii Kondratev, Niklas Adalberth, Sebastian Siemiatkowski, and Victor Jacobsson.

- Business Model: Payment solution for ecommerce

- Total Active Consumers: 150,000,000

- Total Number of Merchants: 500,000+

- Number of Transactions per Day: 2,000,000

- Number of Employees: 5,000+

Just like Klarna transformed digital payments, many companies today are also investing in e-wallet app development. Along with that, services like website development & mobile app development play a key role in building secure and flexible platforms that support modern ecommerce payments and retail payments.

How Does Klarna Work: Klarna Business Model Canvas

Klarna has transformed online shopping with its smart BNPL (Buy Now Pay Later) approach. The company builds seamless digital solutions, including e-wallet app development, website development & mobile app development services.

Here’s a clear breakdown of the Klarna business model canvas and how it works.

1. Customer Segments

- Klarna targets online shoppers and ecommerce retailers.

- Customers range from small local businesses to large international brands.

- Retailers choose Klarna because buyers want flexibility in making purchases.

It connects businesses with shoppers by offering smoother payment options.

2. Value Proposition

- A simplified online shopping experience with one-click checkout.

- Multiple flexible payment options: buy now, pay later, payment after delivery, or zero-interest EMI.

- Customers shop stress-free, while businesses increase sales and reduce cart abandonment.

This is a strong win-win model for both shoppers and retailers.

3. Channels

- Klarna facilitates buy now, pay later transactions via mobile payments, web payments, and API integration with various ecommerce platforms.

- The Klarna Card and Klarna app extend convenience.

- The Klarna website and social media payments add more reach.

These Klarna channels ensure quick, simple, and reliable shopping experiences.

4. Customer Relations

- Klarna focuses on a user-centric approach.

- It listens to users and resolves concerns.

- Offers personalised assistance via chat, email, phone, or social platforms like Facebook and Twitter.

Strong customer support builds loyalty and trust.

5. Revenue Streams

- Both consumers and merchants make one-time payments for Klarna services.

- Merchants pay a transaction fee of 1.5% to 3% per order.

- Monthly charges apply for advanced features.

- Users who default may face default payment fees.

This balanced structure benefits both sides.

6. Key Resources

- Klarna’s strength lies in industry expertise, customer data, and proprietary technology.

- Partnerships with ecommerce platforms boost credibility.

- Its global scale mirrors how e-wallet app development, website development & mobile app development can power worldwide growth.

With the right mix of tech and strategy, Klarna scaled globally.

7. Key Activities

- Daily transaction processing.

- Building business partnerships.

- Credit risk assessment and fraud prevention.

- Continuous platform development.

- Round-the-clock customer support.

These activities keep Klarna competitive in the BNPL market.

8. Key Partners

- Klarna partners with 60,000+ global brands.

- The Amazon partnership helped expand reach worldwide.

- The Alipay partnership opened doors to the Asian market.

Such strong collaborations fuel international growth.

9. Cost Structure

- Klarna manages loan risk management and credit risk for both customers and merchants.

- It spends on infrastructure maintenance, customer support, and salaries.

- Other costs include technology development, marketing, and legal compliance.

These investments keep the business sustainable and scalable.

How Does Klarna Work?

Klarna works with retail merchants and earns a commission on every sale made through its platform.

- Retailers partner with Klarna by signing up and adding the Klarna payment option to their online checkout.

- This is similar to e-wallet app development, website development & mobile app development, which help businesses integrate smooth and secure payment options for users.

To use Klarna, customers must first sign up.

- During onboarding, Klarna runs an initial credit check.

- Klarna runs a quick credit check when onboarding new customers.

- If the customer is approved, they can purchase items using Klarna credit.

- With Klarna, shoppers can pay online without sharing personal financial details.

When a customer opts to check out using Klarna, they can select one of the three Klarna payment options.

- Each time someone checks out, the platform performs a soft credit check.

- This check does not affect the customer’s credit score and usually takes just a few seconds.

When a sale goes through Klarna, the merchant pays a flat fee plus a percentage of the total sale.

- This may sound like a bad deal for retailers, but they see it as a Klarna marketing fee.

- Ecommerce sites that implement Klarna payments have been shown to receive about 44% more orders and a 68% higher order volume.

Customers then receive their order and a Klarna invoice with payment instructions according to the payment option they chose at checkout.

- Klarna creates value for both retailers and shoppers.

- It offers customers a safe, secure, and interest-free way to shop.

- Merchants enjoy increased sales, while customers get convenience and flexibility.

Benefits of Klarna for Retailers

Klarna provides a simple payment service that merchants can easily set up on their sites and apps.

- Klarna pays merchants reliably, which reduces the risk of fraud.

- Retailers see higher conversion rates because shoppers face less commitment at checkout.

- The platform allows merchants to offer financing on their sites with no risk for retailers.

- Setting up Klarna is as easy as integrating e-wallet app development, website development & mobile app development solutions for smooth payments.

Using Klarna, retail payments become easier and safer. Ecommerce payments through Klarna help merchants increase revenue and reduce cart abandonment.

Benefits of Klarna for Consumers

- Traditional payment options do not limit customers.

- Klarna removes uncertainty when ordering products online, especially clothing.

- Shoppers can pay after receiving items, so there is no risk of paying for undelivered items.

- It provides easy access to low-cost credit as an alternative to traditional credit cards.

- The system operates similarly to modern e-wallet app development, website development & mobile app development platforms, making payments simple and secure.

- Klarna gives consumers flexible payments and interest-free installments. The platform ensures safe shopping with a smooth checkout experience.

How Does Klarna Make Money?

When analysing the Klarna business model, there are four main ways Klarna makes money: interest fees, late fees, merchant commissions, and Klarna Card payments.

1. Interest Fees

For users who choose financing for expensive purchases, Klarna charges up to 19.99% APR over 36 months. The exact interest depends on each customer’s credit score.

Customers do not pay interest if they select Klarna’s pay in 30 days or the four-instalment payment option. These interest-free options make online shopping easy and safe. This is similar to seamless e-wallet app development, website development & mobile app development integrations for payments.

2. Late Fees

Klarna charges late fees to customers who miss payments for interest-free options.

As of October 24, 2022, late fees are based on the total order value and divided into tiers. This encourages responsible spending. Even if a customer does not pay, Klarna ensures merchants are paid.

This protects merchants and keeps the BNPL platform sustainable. At the same time, it generates extra revenue from late payments.

3. Merchant Commissions

Every time a customer buys through Klarna, the merchant pays a flat fee plus a percentage of the sale.

- For pay in 30 days and four-instalment options, merchants pay a $0.30 flat fee plus up to 5.99% of the transaction.

- For financing, merchants pay $0.30 plus up to 3.29% per transaction.

These fees apply to both online and in-store sales, helping Klarna earn consistent merchant revenue. This setup works as smoothly as modern e-wallet app development, website development & mobile app development integrations for ecommerce payments.

4. Klarna Card Payments

The Klarna Card is a virtual credit card for in-store purchases at brick-and-mortar stores.

Users can set a budget for specific stores using the Klarna app. They can then add it to Google Wallet or Apple Wallet for easy payments.

Klarna earns from the card through late payments and a monthly fee of $3.99 after the first year. The card also boosts merchant commissions by encouraging more purchases through Klarna.

Retailers Accepting Klarna Card

Big-name retailers where the Klarna Card works include:

- Macy’s

- H&M

- Saks Fifth Avenue

- Sephora

- IKEA

- Nike

- Foot Locker

- The North Face

- GameStop

- 75,000+ other brick-and-mortar retail stores globally

This demonstrates Klarna’s support for both online shopping and in-store payments, providing a seamless BNPL platform experience comparable to e-wallet app development, website development & mobile app development payment systems.

Why Klarna’s Business Model Works

Klarna benefits both customers and merchants:

- Customers get interest-free instalments, pay later options, and secure ecommerce payments.

- Merchants get guaranteed payments, higher sales, and flexible payments without added risk.

The combination of interest fees, late fees, merchant commissions, and Klarna Card payments creates multiple revenue streams, making Klarna a leading BNPL platform globally.

SWOT Analysis of Klarna Business Model

Here’s a simple SWOT analysis of Klarna. Let’s go step by step.

Strength

Klarna is very popular. It offers multiple payment options, making online shopping easy.

The platform utilises advanced banking software and boasts experience in both website development & mobile app development. This helps Klarna stay ahead of competitors. It also gives risk protection, making payments safer for customers.

These strengths make Klarna reliable for merchants and shoppers. They also support e-wallet app development for businesses, adding payment options.

Weakness

Klarna lets users control their payments. This is good for customers, but risky for Klarna.

If too many users miss payments, it can hurt Klarna’s finances. This is a key weakness in their business model.

Opportunities

Klarna works in only 10 countries now. There is a significant opportunity to expand into other markets.

Expanding to Africa and Central America can boost growth. It can also increase BNPL adoption in retail and online shopping.

Businesses doing website development & mobile app development can add Klarna. This lets their users pay in flexible, interest-free instalments.

Threats

Growth brings challenges. The fintech and buy now pay later market has more competitors every day.

More competition can lower Klarna’s revenue and affect its customers. This is a big threat when expanding globally.

Even new e-wallet app development providers could take some of Klarna’s market share.

Who Are Klarna’s Competitors?

When it comes to buy now, pay later (BNPL) platforms, Klarna is a well-known name. But it’s not alone. Several companies are competing for the same space in digital payments.

The rise of BNPL has changed how people shop online. It’s also connected to larger fintech trends, including e-wallet app development, website development & mobile app development, which power seamless checkout experiences.

1. Affirm

Affirm is a BNPL platform founded in 2012 in San Francisco, USA. One of its co-founders, Max Levchin, also co-founded PayPal.

Affirm lets users decide how they want to pay for purchases. Options range from 3 to 36 months, depending on approval.

Some of its big-name partners include Shopify, Walmart, BigCommerce, Zen Cart, and Amazon. These integrations highlight how BNPL is tied to website development & mobile app development, making online payments smoother.

2. Sezzle

Founded in 2016, Sezzle is headquartered in Minneapolis, USA. It has a strong hold in North American markets and has also expanded into Europe.

Shoppers in Germany, Austria, Belgium, France, the Netherlands, Italy, Spain, and the UK can now use Sezzle.

Sezzle started as an automated clearing house (ACH) payment system but quickly shifted into BNPL due to demand.

Unlike Klarna, Sezzle doesn’t allow customers to set their own terms. Instead, it follows fixed repayment plans.

In 2022, Sezzle became the first BNPL company to go public—a big milestone for the industry.

3. PayPal

Almost everyone knows PayPal, the global fintech giant. Founded in Palo Alto, USA, in 1998, its creators included Peter Thiel, Max Levchin, Ken Howery, Luke Nosek, and Yu Pan.

To rival Klarna, PayPal offers two services:

- PayPal Credit (once called Bill Me Later)

- Pay in 4 (launched in June 2022)

Pay in 4 lets shoppers split payments into smaller instalments. Repayments can stretch from 6 to 24 months.

Customers can pay bi-weekly or monthly. And unlike many BNPL services, PayPal doesn’t charge late fees.

At the moment, Pay in 4 is only available in select markets such as the US, UK, Germany, France, Italy, Spain, and Australia.

This expansion shows how BNPL services work hand-in-hand with e-wallet app development, creating smooth digital transactions.

4. Afterpay

Afterpay is a major BNPL provider based in Australia. Founded in 2014, it now serves customers in the US, UK, Canada, and New Zealand.

A key difference from Klarna is that Afterpay doesn’t check credit scores. It also doesn’t report delinquencies to credit bureaus.

In August 2021, the US fintech company Square (now Block) acquired Afterpay for a massive $29 billion acquisition.

This deal boosted Afterpay’s global reach and strengthened Block’s place in the BNPL industry.

5. Splitit

Launched in 2021 and headquartered in New York City, USA, Splitit offers something different.

While most BNPL competitors focus on consumer payments, Splitit targets B2B sales. Its primary users are business suppliers and companies.

Splitit allows businesses to spread payments over time. It also provides business credit loans, making it a solid alternative to traditional bank financing.

This B2B model positions Splitit as more than just a BNPL tool—it’s part of broader business financing strategies tied to online commerce.

6. Zip

Another important name is Zip, a BNPL service gaining popularity worldwide.

Zip focuses on flexible, interest-free instalment options. Like Klarna, it partners with online retailers to make shopping more convenient.

Its growing presence highlights how BNPL services connect with website development & mobile app development to create customer-friendly checkout flows.

How Can Protocloud Technologies Help in Finance App Development Like Klarna?

Building a fintech app like Klarna may seem challenging, but it’s not impossible. Success needs three things: the right tech stack, an expert team, and a solid business strategy.

That’s where Protocloud comes in. We combine advanced technology with skilled designers, developers, and project managers. Our services include modern technologies like: AI development, e-wallet app development,

and website development & mobile app development. Together, these solutions help businesses launch powerful apps and achieve sustainable growth.

Final Thoughts

Technology is moving fast, and businesses must keep up. Klarna proves how smart use of modern tools can transform the fintech industry.

Its strategy of partnering with big brands has fueled rapid growth. Klarna’s model isn’t profitable yet, but reinvesting profits keeps it ahead of the competition.

At Protocloud, we share the same vision. We build future-ready apps and digital solutions that help businesses innovate, expand, and stay competitive.

Leave a Reply